India’s IPO Boom Outpaces Two Decades of Growth, $20 Billion Forecast for 2026

Equirus Capital reveals record-breaking fundraising, rising OFS trends, and a transformative shift in investor appetite and regional participation

India’s capital markets have entered a new era of dynamism, with initial public offerings (IPOs) in the last five years raising more capital than the previous two decades combined. According to data released by Equirus Capital, companies raised ₹5,394 billion through IPOs between 2020 and 2025—surpassing the ₹4,558 billion raised from 2000 to 2020. What makes this surge even more remarkable is that it was achieved with just 336 IPOs, compared to 658 issues in the earlier 20-year period.

This dramatic shift reflects a fundamental transformation in India’s financial ecosystem. The average IPO size has more than doubled, rising from ₹692 crore in the 2000–2020 period to ₹1,605 crore in the last five years. This signals a maturing market where larger, more ambitious listings are becoming the norm.

Offer for Sale Gains Prominence

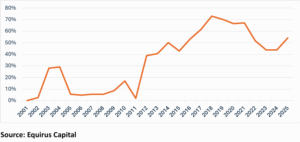

One of the defining features of this IPO boom is the growing share of Offer for Sale (OFS) transactions. Promoters and financial sponsors are increasingly leveraging IPOs to monetize equity holdings, with OFS now playing a central role in exit strategies. Equirus data shows a steady rise in OFS as a percentage of total funds raised, reflecting the market’s growing comfort with secondary share sales.

Private equity (PE) exit trends further reinforce this momentum. In the first ten months of 2025, secondary sales in PE exits more than doubled—from 7% in 2024 to 16%. While block deals remain dominant, their share has declined from 67% to 56%, indicating a diversification in exit routes. With $165 billion worth of PE investments approaching maturity, this deal volume is expected to grow significantly in the coming years.

Structural Shifts Defining 2026

Equirus Capital forecasts that IPO fundraising will touch $20 billion in 2026, driven by three major structural trends:

- Investor Appetite for New-Age and Digital Economy IPOs The rise of tech-driven businesses and digital-first platforms has captured investor interest, with startups and scale-ups increasingly turning to public markets for growth capital.

- Large-Size IPOs Deepening Market Liquidity Mega listings are setting new benchmarks, attracting institutional capital and enhancing depth in secondary markets. These offerings are not only raising more funds but also improving price discovery and investor participation.

- Democratisation of Capital Markets IPOs from Tier-2 and Tier-3 cities now account for over 25% of total IPO value, up from just 4% in 2021. This shift reflects the growing entrepreneurial energy beyond metro hubs and the increasing accessibility of capital markets to regional businesses.

Domestic Flows Strengthen Market Depth

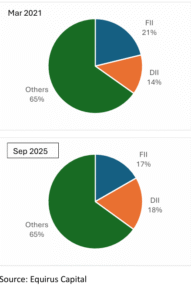

India’s economic momentum—driven by manufacturing revival, Make in India, and Atmanirbhar Bharat initiatives—has bolstered investor confidence. Domestic institutional investors (DIIs) have emerged as a powerful force, now surpassing foreign institutional investors (FIIs) in ownership of NSE-listed companies. This shift marks a significant rebalancing of market influence, with DIIs playing a more active role in shaping investment narratives.

Equirus data shows that DII ownership rose from 14% in March 2021 to 18% in September 2025, while FII ownership declined from 21% to 17% over the same period. This trend underscores the resilience of domestic capital and its growing role in supporting India’s equity markets.

Equirus Capital’s Role in Market Evolution

Equirus Capital has been at the forefront of this transformation. With over 315 transactions across M&A, PE, IPOs, QIPs, Rights Issues, and Structured Finance, the firm has raised $15 billion across sectors over the last 18 years. Founded by veteran investment banker Ajay Garg, Equirus is backed by marquee investors including the late Rakesh Jhunjhunwala, Amicus Capital, and Federal Bank. Its meritocratic structure, where employees hold significant equity, reflects a culture of ownership and long-term value creation.

Bhavesh Shah, Managing Director and Head of Investment Banking at Equirus, attributes the surge in IPO activity to a combination of investor confidence, promoter readiness, and evolving market structures. “India is standing out as a place where investors can find sustainable growth,” he said. “In 2026, we see a strong pipeline of IPOs and expect capital raising via this route to touch $20 billion.”

Conclusion

India’s IPO landscape is undergoing a profound transformation. With larger deal sizes, rising OFS participation, and broader regional inclusion, the capital markets are becoming more inclusive, liquid, and future-ready. As domestic investors take center stage and new-age companies tap public markets, the next phase of India’s financial evolution promises to be bold, expansive, and deeply rooted in sustainable growth.

Equirus Capital’s insights and leadership offer a compelling lens into this journey—one where capital, innovation, and opportunity converge to shape the future of Indian enterprise.