Groww’s Parent Company Billionbrains Garage Ventures Announces ₹6,632 Crore IPO to Accelerate Fintech Expansion

With a fresh issue of ₹1,060 crore and a major offer-for-sale component, the IPO aims to strengthen Groww’s leadership in digital investing and wealth creation

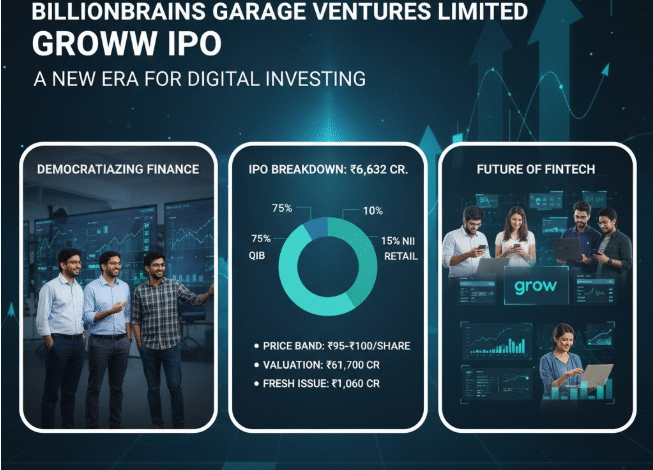

Billionbrains Garage Ventures Limited, the parent company of leading fintech platform Groww, has officially announced its Initial Public Offering (IPO), marking a pivotal moment in India’s digital investment landscape. The IPO, valued at ₹6,632 crore, is set to be one of the most significant public listings in the fintech sector this year, reflecting investor confidence in the company’s growth trajectory and market leadership.

Founded in 2017, Groww has rapidly evolved into one of India’s most trusted platforms for retail investing. It offers a seamless, direct-to-customer digital interface that enables users to invest in mutual funds, stocks, futures & options, ETFs, IPOs, digital gold, and even US equities. With a user base that spans across metros and Tier-2 cities, Groww has democratized access to financial markets for millions of Indians.

The IPO comprises a fresh issue of equity shares worth ₹1,060 crore, which will be used to bolster the company’s technological infrastructure, expand product offerings, and enhance customer acquisition efforts. In addition, the IPO includes an Offer For Sale (OFS) of 574,190,754 equity shares by existing promoters and investors, amounting to ₹5,572 crore.

The price band for the IPO has been set at ₹95–₹100 per share, with a minimum lot size of 150 shares. At the upper end of the price band, the company is targeting a valuation of ₹61,700 crore (approximately USD 7 billion). This valuation underscores Groww’s position as a frontrunner in India’s fintech ecosystem, competing with global players in terms of scale, innovation, and customer engagement.

The IPO is being managed by a consortium of top-tier Book Running Lead Managers (BRLMs), including Kotak Mahindra Capital Company Limited, J.P. Morgan India Private Limited, Citigroup Global Markets India Private Limited, Axis Capital Limited, and Motilal Oswal Investment Advisors Limited. Their involvement signals strong institutional backing and robust market interest in the offering.

According to public disclosures, 75% of the shares are reserved for Qualified Institutional Buyers (QIBs), 15% for Non-Institutional Investors (NIIs), and 10% for retail investors. This allocation structure is designed to ensure broad-based participation while maintaining strategic investor alignment.

The proceeds from the fresh issue will be directed toward product development, platform scalability, and regulatory compliance. Groww plans to deepen its penetration into underserved markets, introduce new asset classes, and enhance its AI-driven advisory tools to improve investor outcomes.

The company’s founders—Lalit Keshre, Harsh Jain, Neeraj Singh, and Ishan Bansal—have played a crucial role in shaping Groww’s customer-first philosophy and tech-enabled operations. Their vision has helped the platform achieve rapid growth while maintaining high standards of transparency, security, and user experience.

Industry analysts view the IPO as a bellwether for India’s fintech sector, which continues to attract significant capital amid rising demand for digital financial services. Groww’s listing is expected to pave the way for other fintech startups to explore public markets, reinforcing the sector’s maturity and scalability.

As the IPO gears up for launch, Groww remains focused on its mission: to make investing simple, accessible, and rewarding for every Indian. The public listing is not just a financial milestone—it’s a strategic leap toward building a more inclusive and empowered financial future.